Auto insurance can be tough to understand, with many myths out there. These myths make it hard to know how rates are set, what discounts you can get, and what coverage you need. This article aims to clear up these misunderstandings, helping you make better choices and maybe even save some money.

Key Takeaways

- Uncover the truth behind common myths surrounding auto insurance rates.

- Discover the various discounts and savings opportunities available to policyholders.

- Understand the difference between mandatory and optional auto insurance coverages.

- Learn how factors like driving record and credit score impact your insurance premiums.

- Explore strategies to maximize your auto insurance savings without sacrificing coverage.

Also Read: Navigating Health Insurance: Key Insights on Deductibles, Quotes, and Family Coverage

Understanding the Basics of Auto Insurance

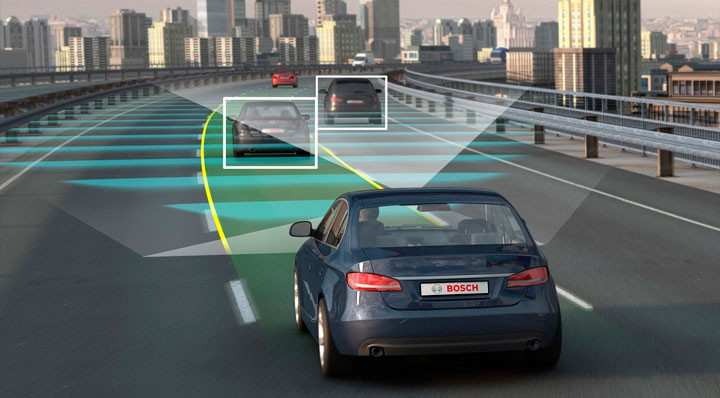

Auto insurance can seem complex, but knowing the basics is key. Policies have both mandatory and optional coverages. Each one has a purpose to protect drivers in accidents.

Mandatory vs. Optional Coverages

Law requires mandatory coverages, like liability insurance. It covers damages and injuries to others in an accident. Collision insurance and comprehensive insurance are optional. They protect the driver’s own vehicle.

Liability, Collision, and Comprehensive Explained

Liability insurance pays for damages and injuries to others if you’re at fault. Collision insurance covers repairs if your car hits something. Comprehensive insurance covers damage from theft, vandalism, or natural disasters.

Knowing the difference between these coverages helps drivers choose the right protection. It ensures they’re covered in unexpected situations.

Dispelling Common Myths About Auto Insurance Rates

Many people think that auto insurance rates are all about the car you drive and your age or gender. But, that’s not the whole story. Insurers look at many things, like your driving history, credit score, and where you live.

One big myth is that driving a red car means higher insurance costs. But, it’s not the color that matters. Insurers care more about the car’s safety features, engine size, and how hard it is to replace. Age and gender do play a role, but they’re just a small part of the equation.

Knowing what really affects your insurance rates can help you save money. Keeping a clean driving record, improving your credit, and using discounts are all good ways to lower your costs. By understanding these factors, you can get better rates and enjoy more affordable insurance.

Auto Insurance Myths and Facts

Auto insurance has many myths that can confuse people and make premiums higher. Let’s look at two common myths and the facts that debunk them.

Myth: Red Cars Cost More to Insure

Many think red cars cost more to insure. But, the truth is, the color of your car doesn’t affect your rates. The car’s color is not a factor that insurers consider when determining premiums. What really matters are the car’s make, model, safety features, and who’s driving it.

Fact: Driving Record and Credit Score Matter

Your car insurance rates are greatly influenced by your driving record. Insurers look at your history of accidents, traffic violations, and claims. They also check your credit score, seeing it as a sign of financial responsibility and risk.

Keeping a clean driving record and a good credit score can save you a lot on car insurance.

Also Read: The Ultimate Guide to Life Insurance: Types, Benefits, and Premiums Explained

Exploring Money-Saving Discounts and Strategies

Finding ways to save on auto insurance can be tough. But, there are a few strategies that can help. One good way is to bundle your auto insurance with other policies, like homeowner’s or renter’s insurance. This can lead to discounts that lower your costs a lot.

Bundle Policies for Discounts

Many insurance companies give discounts if you insure more than one thing with them. For example, insuring your car and home together can save you a lot of money. Make sure to check what bundling options your insurance company offers to get the best deal.

Safe Driving and Loyalty Rewards

Safe driving and being loyal to your insurance company can also save you money. Insurance companies give discounts to safe drivers because they are less likely to have accidents. Plus, many companies offer loyalty programs that reward you for sticking with them year after year.

Does buying a cheaper car guarantee lower insurance rates?

Insurance rates depend on the car's safety features, repair costs, and likelihood of theft, not just the purchase price.

Will raising your deductible lower your premiums?

Increasing your deductible can lower your monthly premiums, but it means you’ll pay more if you file a claim.

Will getting older automatically lower your insurance rates?

While age can affect premiums, insurance rates are more influenced by your driving history, location, and claims.

Do all auto insurance policies cover rental cars?

Some policies cover rental cars while others do not. It’s important to check your specific policy or add coverage.

Will your rates drop if you don’t make a claim for several years?

Some insurers offer discounts for not making claims over a period, but not all policies have this feature, so it’s important to check.

Do low-mileage drivers always pay lower insurance rates?

While driving fewer miles can reduce premiums, other factors like your driving history and the type of car also play a role.

Can bundling home and auto insurance save you money?

Most insurers provide discounts if you bundle multiple types of insurance, like home and auto, with the same company.

Does your credit score affect your insurance rates?

Many insurers in certain states use credit scores to assess risk, meaning a lower score could lead to higher premiums.

Can driving courses help reduce your insurance rates?

Many insurers offer discounts for completing defensive driving courses, as they reduce the likelihood of accidents.

Do red cars really cost more to insure?

Car color has no bearing on insurance premiums. Rates are influenced by the car's make, model, and safety features, not its color.